Where Capital Builds Trust —

and Trust Builds Nations

Next-generation merchant banking combining AI-powered underwriting, tokenized sovereign debt, and transparent capital markets across Latin America.

Comprehensive Financial Services

Merchant Bank 2.0 combines traditional merchant banking expertise with cutting-edge technology to deliver unprecedented value.

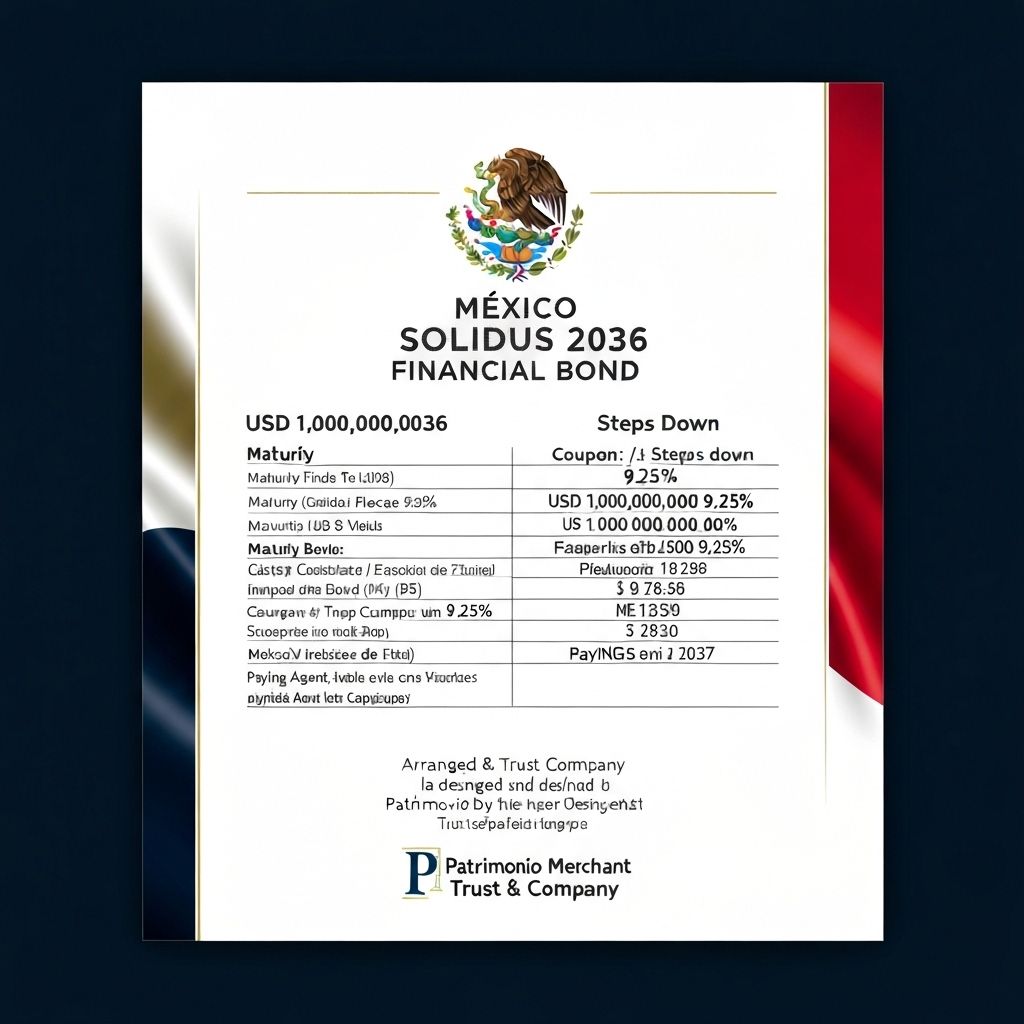

Solidus™ Smart Bonds

Revolutionary tokenized sovereign debt instruments that combine transparency, performance-based pricing, and real-time tracking. Every dollar is visible, every milestone is verified.

Strategic Market Presence

Operating across Latin America's most dynamic economies with tailored Solidus™ bond solutions for each market.

Leveraging Bitcoin regulation and fintech openness for pilot programs and BaaS infrastructure.

Flagship tokenized bonds and diaspora-linked micro-bonds for infrastructure development.

Anchor for institutional ESG investors with strong regulatory precedent and green finance.

Gateway for offshore banking compliance, custody services, and cross-border transactions.

Major private credit and manufacturing base for tokenized working-capital programs.

Phase II expansion focusing on tokenized energy projects and AI-finance infrastructure.

Portfolio Companies

Strategic investments across financial technology, defense, and capital markets infrastructure

Privatus Defense

Defense & Security Solutions

PMX Global

Global Trading Platform

Brickell Exchange

Digital Asset Exchange

CDMX Exchange

Mexico City Exchange

Bay52

Investment Platform

VOC Family Office

Family Office Services

Founders Trust Capital

Venture Capital

Distress Exchange

Distressed Asset Platform

1889 GWM

Global Wealth Management

Patrimonio EX

Exchange Platform

Patrimonio Partners

Strategic Partnerships

Investor Information

A compelling investment opportunity in the future of Latin American capital markets.

About Patrimonio Merchant Trust & Co.

The Future of Trust, Built on Legacy

Patrimonio Merchant Trust & Company represents the evolution of merchant banking for the digital age. We combine the time-tested principles of traditional merchant banking—discretion, discipline, and fiduciary excellence—with cutting-edge technology including artificial intelligence, blockchain infrastructure, and programmable finance.

Our Vision

To become the operating system for programmable capital across Latin America, democratizing access to sophisticated financial instruments while maintaining the highest standards of transparency and accountability.

Our Mission

To unlock liquidity for corporations, sovereigns, and infrastructure projects through AI-powered underwriting, tokenized capital markets, and transparent governance—building trust through technology.

The Merchant Bank 2.0 Difference

Core Principles

Integrity in Motion

Every transaction is transparent, every commitment is honored, every relationship is built on trust.

Intelligence Through Data

AI and machine learning transform subjective banking art into quantitative science.

Innovation with Discipline

We embrace cutting-edge technology while maintaining rigorous risk management and compliance.

Impact with Accountability

Our smart bonds and tokenized instruments ensure capital creates measurable, verifiable impact.

Get in Touch

Ready to explore the future of merchant banking? Contact us to learn more about our services and investment opportunities.

Santo Domingo, Dominican Republic

investors@patrimonio-trust.com

+1 809 XXX-XXXX (DR)